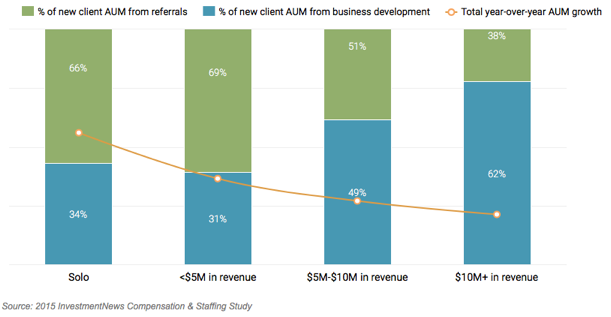

If your answer is yes, you’re probably not alone. In its most recent annual benchmarking study, InvestmentNews found that as advisory firms grow, business development (prospecting and marketing) becomes increasingly important for the most profitable firms – often times, as depicted below, at the same time that referrals take a lesser role.

Another conclusion reached by the study is that many firms begin by growing through referrals, but the most successful ones then master how to continue their grow through business development. But interestingly, the study also show that the most profitable firms at all stages of growth are those that rely less on referrals than their counterparts. Finally, the study showed that the top performing firms spend 50% more on their business development efforts than their peers.

This study is consistent with other studies that I have seen lately which show that high net worth individuals are becoming more reluctant to make referrals.

The bottom line lesson here is that reliance on referrals only – while maybe an acceptable practice in the past – is becoming increasingly difficult. It’s 2017 business planning time – consider taking the time to clearly define your target markets, make any necessary adjustments to them and develop a marketing plan that focuses on more proactive client acquisition.

Don’t stop asking for referrals; just stop counting on them.